About US

TCC

TCC Financial (TCC) is an alternative capital provider to public & private mid-market enterprises seeking custom finance solutions outside of those offered by traditional lending institutions. Initially created as a means to service and expand the existing client base, TCC Financial has developed into a full-scope financier providing asset-based loan & lease solutions to borrowers facing a variety of traditional funding challenges, from transitional and distressed balance sheet restructurings to rapid-growth working capital and acquisition requirements. TCC Financial is a member of the Group of Companies, who possess over 40-years of asset-based lending experience and is a leading provider of equipment finance and speciality loan & lease arrangements.

With a deep understanding of asset-finance and operation management, TCC Financial is able to evaluate a borrower’s capital needs and inherent risks from an enterprise perspective, allowing for tailored, creative, and timely credit solutions.

Why Private Debt

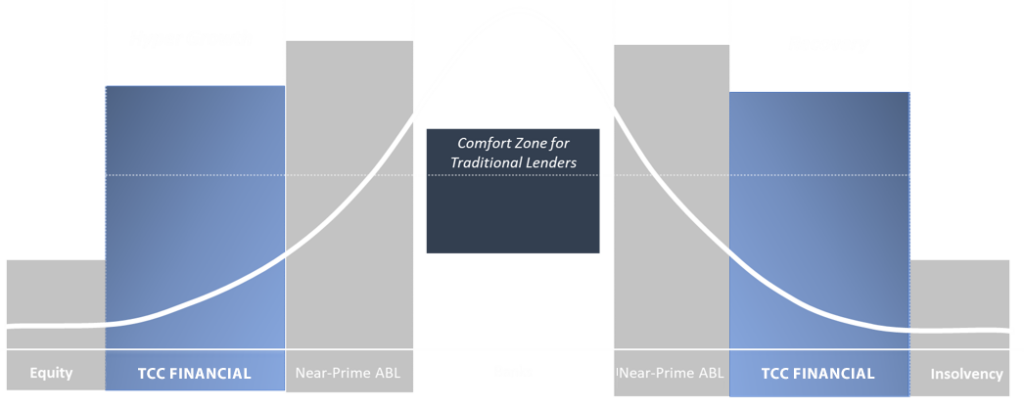

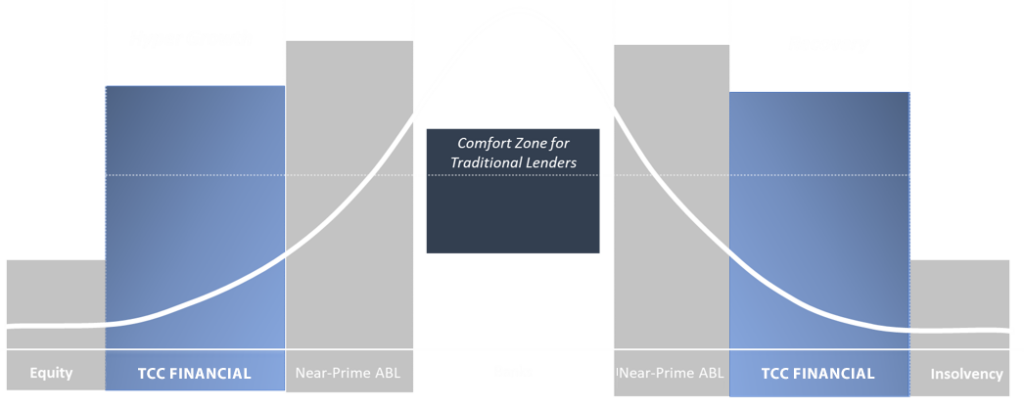

Defined as any credit extended outside of traditional banking networks or public markets, private debt has become an exceedingly prevalent form of alternative capital for small to mid-market size enterprises over the last decade. Private debt has filled an important void in the North American capital markets and circumvents many of the challenges that accompany traditional financial institution underwriting guidelines, such as rigid financial and reporting covenants, strict loan to value and cash flow parameters, and convoluted approval procedures.

TCC works closely with clients at every stage of the corporate life cycle to better understand their assets, their business, and their credit needs to provide custom capital solutions outside of those offered by traditional banks.

Meet Our Team

Breakspear has experienced notable success in the capital allocation space at a retail, high net worth, and institutional level.

About US

TCC

TCC Financial (TCC) is an alternative capital provider to public & private mid-market enterprises seeking custom finance solutions outside of those offered by traditional lending institutions. Initially created as a means to service and expand the existing client base, TCC Financial has developed into a full-scope financier providing asset-based loan & lease solutions to borrowers facing a variety of traditional funding challenges, from transitional and distressed balance sheet restructurings to rapid-growth working capital and acquisition requirements. TCC Financial is a member of the Group of Companies, who possess over 40-years of asset-based lending experience and is a leading provider of equipment finance and speciality loan & lease arrangements.

With a deep understanding of asset-finance and operation management, TCC Financial is able to evaluate a borrower’s capital needs and inherent risks from an enterprise perspective, allowing for tailored, creative, and timely credit solutions.

Why Private Debt

Defined as any credit extended outside of traditional banking networks or public markets, private debt has become an exceedingly prevalent form of alternative capital for small to mid-market size enterprises over the last decade. Private debt has filled an important void in the North American capital markets and circumvents many of the challenges that accompany traditional financial institution underwriting guidelines, such as rigid financial and reporting covenants, strict loan to value and cash flow parameters, and convoluted approval procedures.

TCC works closely with clients at every stage of the corporate life cycle to better understand their assets, their business, and their credit needs to provide custom capital solutions outside of those offered by traditional banks.

Meet Our Team

Breakspear has experienced notable success in the capital allocation space at a retail, high net worth, and institutional level.

TCC Financial Inc. All Rights Reserved ©

The member of: